does arizona have a solar tax credit

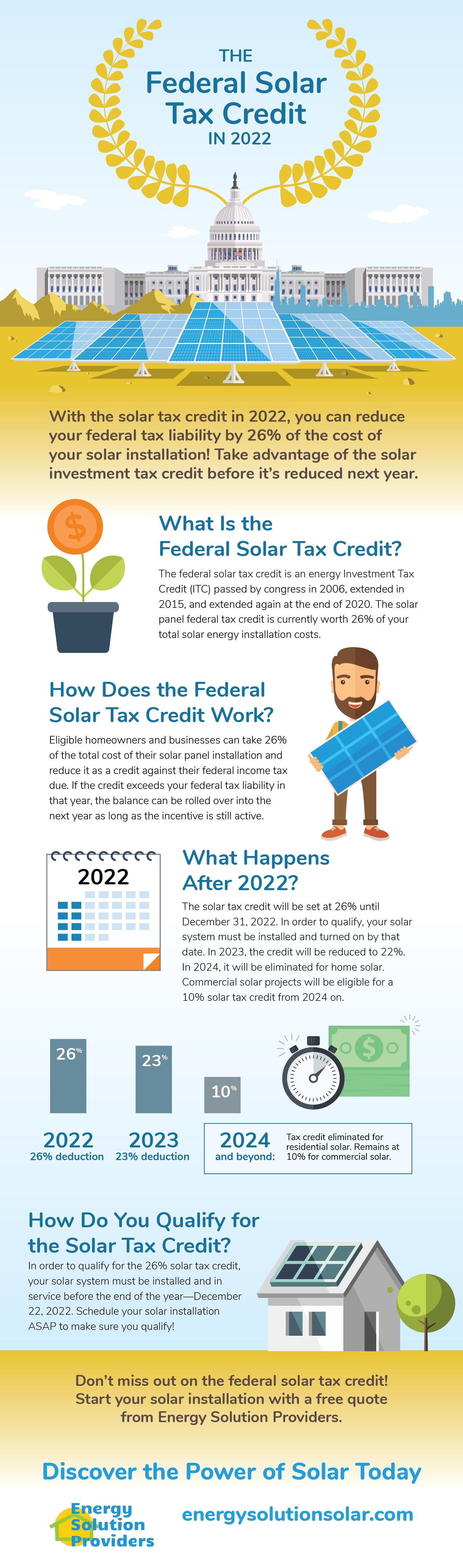

Other solar tax benefits throughout Arizona. The ITC will lower to 22 in 2023 and will be removed completely for residential solar system projects in.

Solar Incentives At A Glance.

. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. Arizona offers three different types of incentives when you purchase your solar panels. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

Summary of solar rebates in Arizona. Arizona State Energy Tax Credits. The 25 state solar tax.

Worth 26 of the gross system cost through 2020. If another device is installed in a later year the cumulative credit cannot exceed 1000 for the same residence. The credit is allowed against the.

23 rows NOTICE. The Residential Arizona Solar Tax Credit reimburses you 25 of the cost of your solar panels and up to 1000 on your personal income tax in the year you install the system. The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022.

Arizona is one of the best solar states not just because of the abundance of sunlight but also because of the states legislation. These credits and rebates help you save on the initial purchase or prevent you from. The federal solar tax credit also known as the investment tax credit was built to save home and business owners on the upfront cost of solar.

The federal solar tax credit. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percentKeep in. June 6 2019 1029 AM.

As a credit you take the amount directly off your tax payment rather than as. The Renewable Energy Production tax credit is for a. Dont forget about federal solar incentives.

You can only claim up to 1000 per calendar year on your state taxes. The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. Arizona Credit for Solar Hot Water Heater Plumbing Stub Out and Electric Vehicle Charging Station Outlet.

Residential Arizona Solar Tax Credit. Incentives for homeowners to make the switch to solar have historically been offered at the federal state and local Arizona utilities levels. This means that in 2017 you can still get a major discounted price for your.

For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. This perk is commonly known as the. Arizonians who install solar panels on their property have access to.

For 2021 and 2022 homeowners can receive a. This 75 credit is provided for in Arizona Revised Statutes 43-1090 and 43. An Arizona state tax credit up to 100000 A 26 federal solar tax credit.

Arizona Department of Revenue E-Services applications. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. The Residential Arizona Solar Tax Credit gives you back 25 of the cost of your.

Check out all of the Arizona solar tax credits rebates and incentives. Residential Arizona Solar Tax Credit. To claim the tax credit your solar system must be installed before the end of 2022.

The 30 tax credit applies as long as the home solar system is installed by December 31. Arizona Department of Revenue tax credit. However unlike the federal governments tax credit incentive Arizona tax credits have a limit.

The tax credit remains at 30 percent of the cost of the system. Federal solar investment tax credit. To claim this credit you must also complete Arizona Form.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Arizona. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. Here are the specifics.

Arizona Residential Solar Energy Tax Credit. 1 Best answer. This is a personal solar tax credit that reimburses you 5 of the cost of your solar panels up to 10001000 maximum credit per residence irrespective of.

Arizona Solar Tax Credit Property Tax Exemptions.

Louisiana Act131 Appeals Must Be Filed Within 60 Days Of The Letter Received From Ldr That Formally Deni Solar Energy Panels Solar Energy Diy Solar Panels

Free Solar Panels Arizona What S The Catch How To Get

Solar Tax Credit In 2021 Southface Solar Electric Az

Imagem Gratis No Pixabay Fotovoltaicas Sistema Solar Solar Energy Panels Solar Panels Solar

Cost Of Service Arizona S Solar Saga Takes On The Valuation Question Solar Roof Solar Panel Arizona

Energy Solar Power House Solar Panels Solar Energy Panels

The California Energy Commission Has Required All New Homes Built In That State To Have Rooftop Residential Solar Panels Solar Panels For Home Solar Panel Cost

No Act Of Kindness However Small Is Ever Wasted Pool Solar Panels Solar Pool Solar

Here Comes The Sun The Growth Of Residential Solar Energy Infographic Solar Energy Facts Residential Solar Solar Energy For Home

Crystalline Silicon Solar Panels Work Efficiently Even In Low Light Compared To Other Pv Cells Solarenergy Solar Best Solar Panels Solar Panel Installation

New Report Shows Solar Jobs Outpacing Coal Everywhere Especially The South Energy Research Solar Solar News

Is Solar In Arizona Actually Free

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Off Grid Solar Kit Northern Arizona Wind Sun Solarpanelkits Solar Panel Installation Solar Panel System Solar Kit

Attention Southern Nevada New Construction Buyers My Team And I Can Now Include Solar Into Your Mortgage Give Us A Call To Fi Mortgage Las Vegas Homes Solar

The Federal Solar Tax Credit Energy Solution Providers Arizona

Arizona Solar Tax Credits And Incentives Guide 2022

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Superpowers Of Solar A Solar Energy Facts Infographic Solar Energy Facts Solar Energy Solar Energy Savings